Market Commentary - 2.5.15 The Case for Active Management and Diversification The financial markets opened 2014 with caution and an expectation that a rising interest rate environment in the U.S. may hurt both stock and bond prices. Over the course of the year, however, U.S. economic growth continued to improve, while a slowdown in aggregate demand and overall growth abroad kept downward pressure on rates. This led to a continuous strong performance in U.S. equities, and also boosted the returns of longer term bonds. Small cap stock returns were less stellar, while international fixed income and equities posted flat to negative returns for the period, reflecting the slower growth rates in international markets.

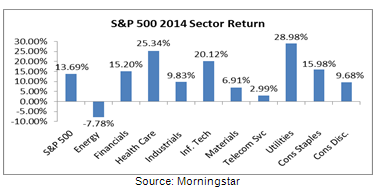

As can be seen from the chart above, the strong returns of U.S. stocks were concentrated in large cap stocks. Small cap stocks as indicated by the Russell 2000 Index lagged their large cap counterparts by over 7%, and even within large caps, the gains were concentrated in a few sectors like Utilities, Healthcare and Technology. In Technology, the gains were even further concentrated as large index constituents such as Apple (APPL), Microsoft (MSFT) and Intel (INTC) were leaders.

International stocks as indicated by the MSCI EAFE Index underperformed U.S. equities for a sixth year in a row, and the performance difference of 17% was the largest in almost two decades.

In fixed income, the unexpected but steady decline in rates drove bond prices higher, helping the returns of longer term bonds. The most interest sensitive bonds fared best, with the Barclays U.S. 20+ Year Treasury Bond Index outperforming even equities and posting a 27.48% return for the year.

In the environment highlighted above, diversification also did not work for most portfolios, as allocations to smaller cap or international stocks, short-term bonds or commodities underperformed the broad large cap indexes that are usually highlighted in the media.

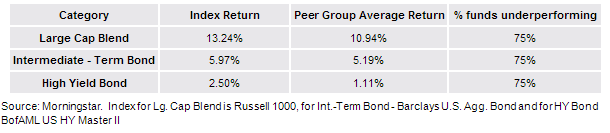

Partly as a result of these developments, 2014 ended up as one of the worst years for active managers, with close to three quarters of funds in several major categories underperforming their benchmarks. Active management, which tends to focus on qualitative measures to make informed investment decisions suffered as gains were concentrated in few sectors and in long term bonds, areas of the market which were widely seen as overpriced at the beginning of the year.

Investors who held a diversified portfolio have noted that their returns have largely trailed the headline numbers. This raises the fair question - is holding a diversified portfolio still worthwhile?

To us the answer to this question is unequivocally yes. While diversification may not always get the highest return in narrow markets such as 2014, a portfolio that is diversified tends to be better positioned to participate if returns in non-U.S. assets revert to historical averages. And as market returns tend to be mean reverting, we believe that a move away from diversification in response to past returns may be ill timed.

Going forward we believe that fundamental valuation will begin to play a larger role in equities as monetary policy normalizes. Typically, supportive economic policy leads to a period of rapid recovery, and in such periods, lower quality names outperform as they have this year. But as the markets shift toward growth, higher quality names, which continue to deliver on earnings and maintain dividends, tend to perform better. Active stock selection based on fundamental research is likely to perform better in conditions of expansion and slow GDP growth - historical returns from Datastream and Goldman Sachs show that in periods of slow GDP expansion, stocks with high or steady earnings per share growth (EPS) may outperform lower EPS growers by as much as 30%.

We are also positive on active management in fixed income. Heightened regulations have constrained liquidity in this space, and active managers are better positioned to weather and take advantage of periods of distress. We also believe that in this space, the increased availability of exchange traded derivatives gives active managers a broader tool kit to manage duration and position portfolios defensively if the need arises. Finally, improved credit research may be critical to adding value in a period when dislocations cause stronger company-specific credits to outperform. In this case, a solid fundamental research team is likely to outperform a broader and market weighted benchmark.

Volatility is likely to remain elevated and we do not know where the markets will head next. But we believe diversification is the best approach to mitigating downside risk, and a continued focus internationally may allow for improved returns as conditions abroad stabilize. We also retain a conviction in active management, as we believe a focus on fundamentals may better serve investors in the intermediate to long term. This information is compiled by Cetera Investment Management.

About Cetera Investment Management

Cetera Investment Management LLC provides passive and actively managed portfolios across five traditional risk tolerance profiles to the clients of financial advisors, who are affiliated with its family of broker-dealers and registered investment advisers. Cetera Investment Management is part of Cetera Financial Group, Inc., which includes Cetera Advisors LLC, Cetera Advisor Networks LLC, Cetera Financial Specialists LLC, and Cetera Investment Services LLC.

About Cetera Financial Group

Cetera Financial Group, Inc. is the cornerstone of the retail advice division of RCS Capital Corporation (RCS Capital) (NYSE: RCAP), which is focused on serving the needs of investors with best-in-class solutions.

Committed to using its collective knowledge and expertise in service to and for others, Cetera Financial Group is focused on the growth of its affiliated broker-dealers and financial professionals’ businesses by giving them the industry and market insight, technology, resources and solutions they need to better focus on helping their clients pursue their financial goals. For more information, visit cetera.com.

No independent analysis has been performed and the material should not be construed as investment advice. Investment decisions should not be based on this material since the information contained here is a singular update, and prudent investment decisions require the analysis of a much broader collection of facts and context. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. The opinions expressed are as of the date published and may change without notice. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision.

All economic and performance information is historical and not indicative of future results. The market indices discussed are unmanaged. Investors cannot directly invest in unmanaged indices. Please consult your financial advisor for more information.

Additional risks are associated with international investing, such as currency fluctuations, political and economic instability, and differences in accounting standards.

Affiliates and subsidiaries and/or officers and employees of Cetera Financial Group or Cetera firms may from time to time acquire, hold or sell a position in the securities mentioned herein. |